The average amount of money that sellers make from selling their homes has fallen below £100,000 for the first time in three years.

Research from Hamptons shows that homeowners in England and Wales sold their home for £92,000 more than they paid for it on average last year, having owned the property for an average of 8.9 years. This is significantly lower than the £113,000 made in 2022, when strong house price growth pushed gross gains into six figures for the first time.

It's clear the end of the pandemic-fuelled race for space (not to mention rising interest rates and economic uncertainty) has moderated house prices over the past few years. Gross profits have cooled alongside the property market, meaning that gains as a proportion of the sale price have fallen to a 10-year low.

Read more from Investors' Chronicle

Where to invest in 2025

The best small-cap income stocks London has to offer

The change has been particularly stark in London. The average home in the capital now sells for 44 per cent more than its purchase price, down from 100 per cent in 2016. Wales (with a 48 per cent appreciation) now takes the top spot. Londoners, once the leader in property price appreciation, have seen typical seller gains fall below £200,000 for the first time in a decade.

Yet long-term gains are still substantial, especially in London where prices rose rapidly before 2016. Calculations from Hamptons suggest that homeowners who bought 20 years ago make an average gain of 83 per cent in England and Wales, and 121 per cent in London. Potential downsizers who've been in situ a long time can still expect to make significant gains from selling the family home.

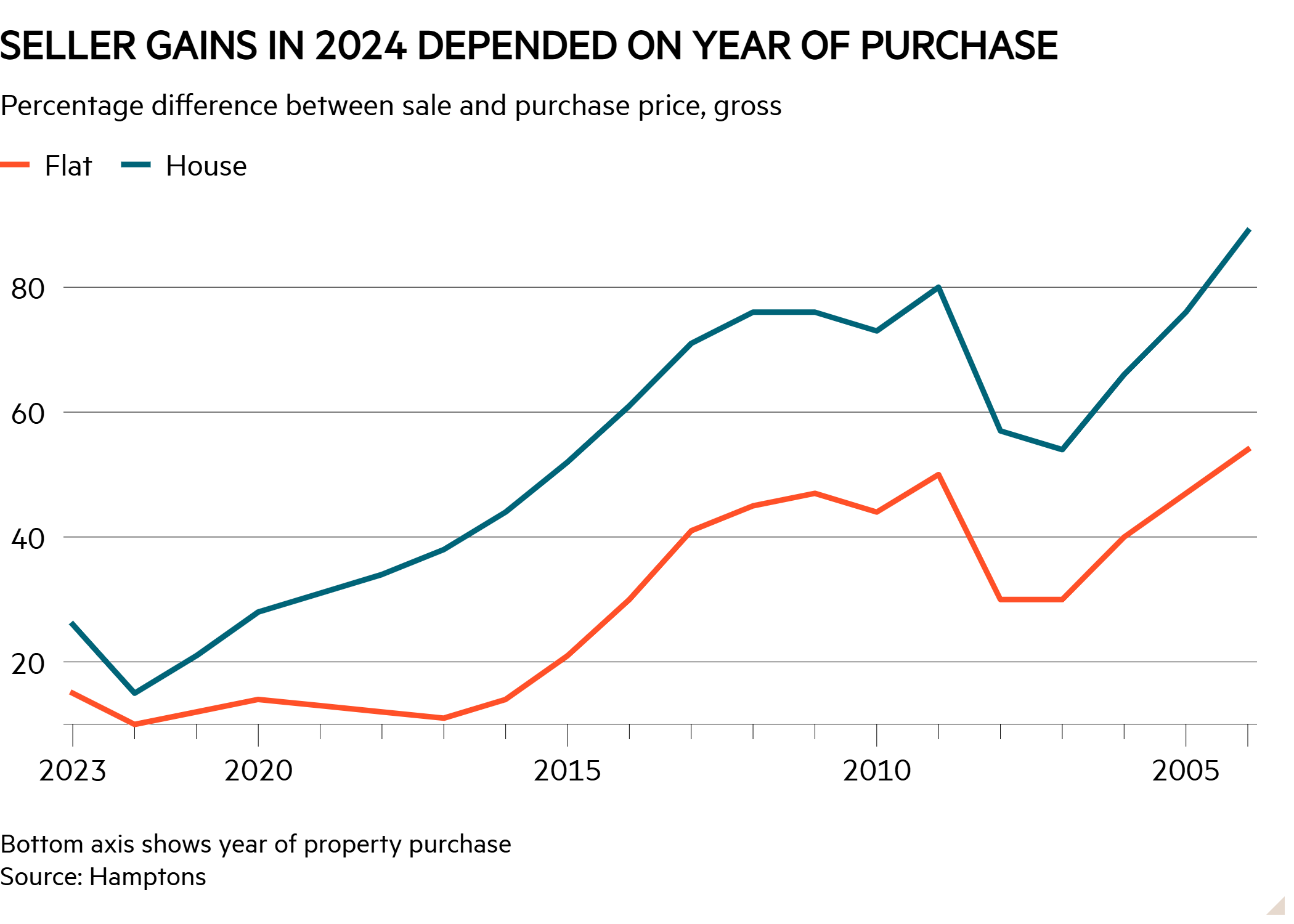

For buy-to-let investors, timing and property type matter even more. Flats have underperformed houses over the past two decades, as the chart below shows. London – home to almost a fifth of buy-to-let properties – again deserves particular attention. A landlord who purchased in the capital more than 12 years ago can expect gains of over 65 per cent. Recent buyers face more dismal results: gains for properties purchased in the past 10 years not only underperform the rest of the country but lag behind inflation, too.

How Labour’s new policies could change things

These forces also make things more difficult for younger buyers: lower equity gains for flats and recent purchases make it harder to move up the property ladder. Hamptons' figures suggest that 32 per cent of flat owners who sold in 2024 had moved within five years, down from 40 per cent in 2019. Without the boost of high equity growth, it is easier to get stuck on the first rung of the ladder.

That is, if you can get on it in the first place – the average first-time buyer still requires a deposit of £53,000 (or £109,000 in London). No surprise then to see recent reports that UK financial regulators are considering increasing mortgage availability for first-time buyers with smaller deposits and lower incomes as part of the government’s regulatory reforms.

This isn’t the only change afoot. The removal of the pensions exemption to inheritance tax in the Autumn Budget has changed estate planning. We could start to see a move towards earlier downsizing, with gains passed on to younger generations for help with house deposits. But this won’t be a silver bullet. Research shows that only one in three people expect to benefit from an inheritance: not every family has property gains to pass along. Selling a main residence can also be fraught with difficulty. Gifting rules complicate arrangements – as do divorces and falling outs.

We (rightly) see houses as an asset. When figures like these are released, it doesn’t hurt to remember that they are also our homes.

3301.jpg)

3301.jpg)

3301.jpg)

3301-2.jpg)