The listed property sector is home to its fair share of bargains. The majority of the sector has been trading at a discount to net asset value (NAV) since interest rates started going up three years ago, and Urban Logistics Reit (SHED) is no exception. The real estate investment trust (Reit) has not traded at a premium to NAV since 2022 and currently sits on a discount of 30 per cent. As we head into 2025, however, this pessimism seems overdone.

IC TIP:

Buy

at

162p

Tip style

Growth

Risk rating

Medium

Timescale

Medium Term

Bull points

- Property risk is driving rents higher

- No debt maturities until 2027

- Diverse range of tenants

Bear points

- Demand for logistics space linked to the wider economy

- Dividend not yet covered

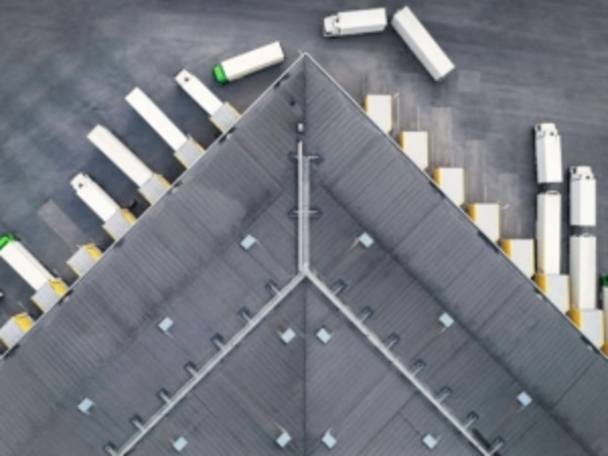

The logistics sector exploded onto investors’ radars during the pandemic as shoppers fled online and businesses discovered the fragility of their own supply trends.